Efficiency in marketing is essential for startups. This is why understanding customer acquisition cost (CAC), also called cost per acquisition (CPA), and its calculation is so important.

What is CAC?

Customer acquisition cost is the amount it costs to acquire a new customer. It equals the total marketing and sales expenses divided by the number of customers won in a period of time.

CAC speaks to the efficiency of marketing spend, actions, sales enablement and deal conversion. It’s the equation to confirm whether efforts at all stages of the acquisition funnel work. Customer acquisition cost is also:

-

- A forecasting tool to accelerate growth

- A way to understand how budgets affect business performance

- The broad target for accelerating business growth

CAC is also complex. Calculating a true customer acquisition cost takes into account multiple elements across business disciplines. The most obvious contributor is marketing. But, it also includes the handoff from marketing to sales, sales team performance, website conversion rates, promotions and other costs.

As a business grows, methods of defining target CACs become more systematic and complicated.

What should our CAC be?

There is no pre-defined customer acquisition cost. CAC is specific to the business model, industry, product and services. Logic says it’s unsustainable to pay more for a customer than that customer’s total value to the business. But, that’s not always true.

For high-growth, high-value SaaS companies, market share might be more important than profit. While for a low-margin, high-volume consumer business, pennies of margin on each sale can be very profitable at scale.

Companies must understand their unique position and build a framework to support it.

OK, how do we build a customer acquisition cost framework to guide decision-making?

Ideal CAC frameworks link to customer lifetime value (CLV).

-

- Example 1: A SaaS company licenses software at $200k per year and deal length of two years. CLV equals $400k and CAC is a percentage of it.

- Example 2: A low-margin, high-volume etailor sells other manufacturer’s products. To calculate CLV, subtract the cost of goods (COGS) first then multiply by the number of purchases and number of years.

Firebrand also works with enterprise-focused startups so later examples will focus on those types of companies.

We just launched, what’s a CAC framework in that context?

New companies don’t have a history or customers to reference, three options are:

-

- Test & Learn: engage marketing across many channels with limited total cost, gather data and use judgment in decision-making

- Guess (i.e. hypothesis): Make assumptions based on industry, product-type, buy-cycle, conversion rates – to calculate a working target customer acquisition cost

- Leverage experience: advisors, employees and research can lead to a reasonable starting point. Ask people who’ve done this before.

How do we calculate a target CAC?

Calculating customer acquisition cost is straightforward. Multiply the average deal value by the average deal length to get customer lifetime value. Then, subtract the company’s desired profit margin to determine how much you should pay to acquire the customer.

For example, the above SaaS software company has an average deal size of $200k and deal length of two years. The company expects an 80% gross profit margin, not unreasonable in the space. The CAC calculation is: $200k * 2 years – 80% = $80k. Whoa, that’s a lot! But, there’s more.

Customer opportunities don’t just appear in front of sales teams, they must be identified, generated and nurtured. CAC connects to the sales and marketing funnel to derive the cost per lead (CPL). Cost per lead is the cost a business is willing to pay to bring someone into its funnel.

We want the customer acquisition cost, what is cost per lead?

The primary business metric is customer acquisition cost. Getting there requires calculations across the whole sales and marketing funnel – lead generation through closing – then working backward to the actual cost a company is willing to pay in marketing costs.

How do we determine what our cost per lead should be?

This calculation is also straight-forward with basic arithmetic and historical performance.

Every new customer was an opportunity. Each opportunity was a sales qualified lead (SQL). Each SQL was a marketing qualified lead (MQL). Each MQL was a lead. Conversion rates at each step determine CPL.

In the example above, CAC = $80k. Assuming conversion ratios of: new customers/opportunities: ⅓, opportunities/SQL: ⅕, SQL/MQL: ⅕ and MQL/lead: ⅕, the Cost per lead (CPL) = $80,000 / 3 / 5 / 5 / 5 = $213 per lead.

So, CPL is what we should spend to acquire customers right?

Broadly, yes. All marketing activity influences all other activity. Startups should focus on high-level blended cost per lead to start and not get bogged down in detail. Why? Because for startups, scale is limited and small shifts have an outsized impact. Start broad and iterate over time.

As the business grows and sophistication increases, CPL calculations need to follow suit with deeper, channel-level calculations.

Startups usually reach this point at Series C/D and often later. Why? The requirements on data, data integrity, systems, integration, attribution, resources and support can be significant.

We’re not there but how granular we can get on cost per lead and customer acquisition cost?

Calculations for CPL and CAC can be further broken down by:

-

- Individual marketing channel

- Marketing campaign

- Geography

- Deal type/size – enterprise vs SMB

- Other elements specific to business model

Most important from a marketing and business perspective is channel-level CPL targeting. because it leads to an optimized marketing mix. Marketing mix refers to the budget ratio, by marketing channel. An optimized marketing mix is an ideal ratio, across all channels, that generates the maximum number of customers at the most efficient cost.

What else about customer acquisition cost (CAC) and cost per lead (CPL) should we know?

There are two final items to consider:

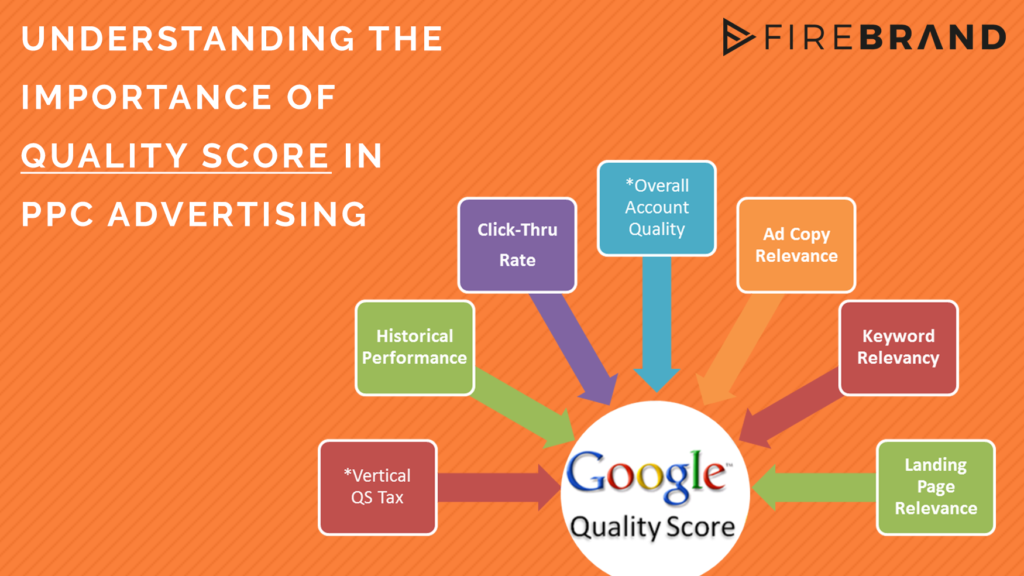

1. Cost: When calculating cost per lead – laddering up to CAC – it’s important to understand the actual business cost. Most obvious is “working cost” or the actual cost of marketing actions. In digital marketing, this is media cost – per click, per view, per mille. Less often considered are “non-working” and “promotional” cost. Non-working costs include the budget for creative development, account management, production costs. Promotional costs are discounts offered to entice a purchase.

2. Attribution: Channel level CPL granularity requires accurate attribution to attribute conversions to the marketing activity that generated it. Digital marketing attribution is complex. Thankfully, most systems do a basic job well. As a company introduces sophistication in marketing, marketing attribution follows. A key element of attribution is the attribution model. Or, the rules that assign credit to specific marketing channel – first touch, last touch, position-based. To learn more, read Firebrand’s “A Beginner’s Guide To Digital Marketing Attribution.”

Attribution for non-digital marketing channels is more complex because it’s not trackable. Think traditional television commercials, terrestrial radio and events for example. Measuring impact and calculating CPL and CAC for these activities must be done in other ways. And, a topic for another post.

Building a startup is hard; doing it efficiently is doubly so. Understanding customer acquisition costs leads to scalable, growth-driving processes. And, linking CAC to business strategy focuses energy toward specific business goals and optimizes finite resources. If you’re new to this and want additional information, Firebrand can help.